- Ethereum price has skyrocketed nearly 70% since July 1, adding $150 billion in market cap.

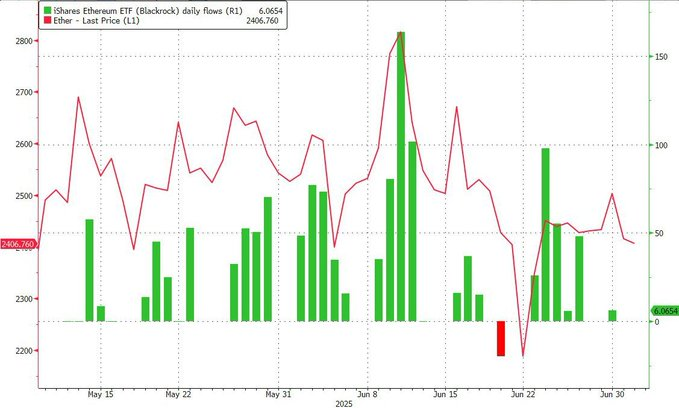

- World Liberty Financial’s $5M ETH purchase and consistent inflows into BlackRock’s Ethereum ETF add fuel to Ethereum’s price surge.

- The U.S. passed major pro-crypto bills and is looking to pass a potential executive order to unlock $8.7 trillion in 401(k) investments.

Ethereum is making headlines with a stunning $150 billion increase in market capitalization since July 1, driven by one of the most significant short squeezes in cryptocurrency history. The rally, detailed in a recent The Kobeissi Letter, has sent shockwaves through the crypto markets, with experts pointing to a mix of institutional moves and potential policy shifts as the catalysts.

The price of ETH has risen 3.6% in the last 24 hours to trade at $3,777 as of 2:00 a.m. EST on a 70% surge in trading volume to $53 billion.

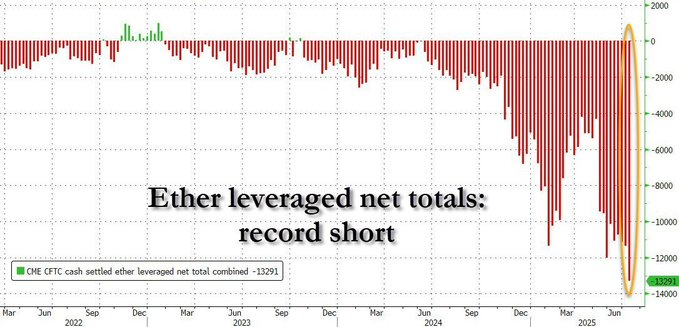

The surge began as net short exposure on Ethereum hit record highs just days before July 1. Short positions spiked 25% above February 2025 levels, setting the stage for a dramatic reversal.

As prices climbed 70% in less than a month, short sellers were forced to buy back the cryptocurrency to cover their losses, fueling the squeeze. The Kobeissi Letter highlighted that if Ethereum rises another 10% to $4,000, an additional $1 billion in short positions could be liquidated.

World Liberty Financial and BlackRock ETF Stack ETH

Adding fuel to the fire, President Trump’s World Liberty Financial platform purchased $5 million worth of Ethereum less than 48 hours ago, a move that has amplified the rally. Meanwhile, BlackRock’s Ethereum ETF has been steadily adding the cryptocurrency, with 29 out of the last 30 days showing inflows before July, despite earlier price dips due to heavy shorting.

As a result, there have been billions of dollars in liquidated ETH shorts, and if the Ethereum price rises another 10%, another $1 billion of shorts will be liquidated according to Coinglass’ ETH Exchange Liquidation Map.

Furthermore, the fact that many of these shorts are leveraged is adding even more pressure, and ETH price could see $4,000 soon.

Crypto Market Rides A Wave of Political Support.

Last week, the U.S. House passed three major bills—the Clarity Act, Genius Act, and Anti-CBDC Act—marking a bipartisan embrace of digital currencies. But even more significantly, President Trump reportedly is set to sign an executive order this week, allowing $8.7 trillion in 401(k) retirement funds to invest in crypto.

With the total crypto market cap currently at $4 trillion, this could unlock capital more than double the industry’s size, a development The Kobeissi Letter calls “historic.”

Bitcoin price is also soaring, with Bitcoin hitting $118,503 and adding $900 billion since its April low. The U.S. dollar’s 10% year-to-date decline, tied to a growing deficit spending crisis, is boosting crypto’s appeal, while institutional investors are increasingly allocating assets to the sector.

Bitcoin’s 90% compound annual growth rate over 13 years has made it a standout performer, and as the market watches closely, analysts note that this rally could redefine global finance.